Shelter Island School Superintendent Brian Doelger has presented the 2021/22 school budget proposal, an initial request that anticipates no need to pierce the state’s tax levy cap.

Further adjustments will be needed to bring the plan under the cap; the max allowable tax levy without a vote to pierce is $11,016,572 including certain exclusions, he said.

The proposal includes funding for extracurricular and athletics in the hope that health concerns will have eased and allow a full return to these activities. Dr. Doelger said the budget proposal, while still very much in draft form and subject to change, is the furthest along of any initial plan he’s drafted.

“We’ve really presented almost a complete budget,” he said.

The school board will review the proposal in Zoom meetings on February 24 and March 8. To get access details, send an email to district clerk Jacki Dunning at jacki.dunning@shelterisland.k12.ny.us.

Budget Summary

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | 2021/22 Proposed Budget | % Change | |

| Central Administration & Support | $930,115 | $891,019 | $958,722 | +3.08 |

| Operations & Plant Maintenance | $916,141 | $864,908 | $948,081 | +3.49 |

| Instruction | $5,860,660 | $5,219,401 | $6,087,093 | +3.86 |

| Transportation | $512,400 | $414,512 | $512,278 | -0.02 |

| Benefits | $3,333,142 | $2,150,548 | $3,253,502 | -2.39 |

| Debt Services/Transfers | $597,563 | $132,902 | $622,813 | +4.23 |

| Total | $12,150,022 | $9,673,290 | $12,382,489 | +1.91 |

[Note: All tables are from the February 8, BOE meeting and figures are subject to change.]

Dr. Doelger kicked off the presentation — which was peppered in his usual fashion with thanks to staff, students, and the wider community for pulling together under duress — with a list of recent accomplishments:

- Addition of Pre-K 3 Program

- Continuing District Improvement Plan

- Revamping of AIS Process

- Continued focus on Social and Emotional Learning (SEL)

- Negotiated a new 5-year teacher contract

- Full-time, in-school education with 20 percent enrollment increase and savings

- Unspent savings from COVID-19 have been put into reserves

- For COVID, purchased technology, air filters, desks, tri-folds, markings, sinks, etc.

“We’ve probably had more in-school education than almost any other school on Long Island,” Dr. Doleger said.

Budget process

The usual process will be followed. To date, administrators have:

- Consulted with teachers and staff to determine programmatic wishes and goals for the 2021/22 school year

- Examined the value and efficacy of existing programs to determine if changes are needed

- Gathered pricing, contractual obligations and best estimates in compiling the spending plan

Now the Board of Education will review the decisions to determine if they represent the proper direction for the district and taxpayers, he said. Goals for this year are to design, develop and adopt a budget that:

- Stays within the tax cap limitations

- Maintains district programs and community support

- Values fiscal restraint

- Seeks to identify and implement cost savings

- Helps us transition from pandemic to post-pandemic educational needs

Budgeting basics

Dr. Doelger noted there are two sides to the budget — the expenditure plan that’s voted on by the community in May and the revenue plan that’s determined by the Board of Education.

“Both the expenditure and revenue budgets represent the best estimates as to what the District’s financial needs will be in 2021/22,” he said. He described the budget as “an aspirational document … that evolves throughout the year as plans are achieved or contingencies become realities.”

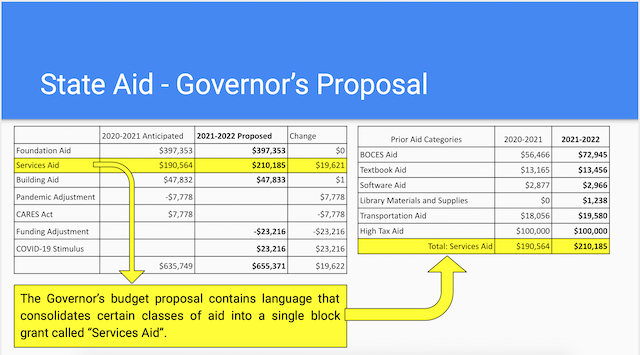

Essential to the revenue side of the plan is the state aid package. Governor Andrew M. Cuomo has released state aid figures for all districts, but they will not be confirmed until the state budget passes (due to happen on April 1). Different this year for state aid, Cuomo has:

- Proposed a budget that incorporates Federal stimulus money as part of the aid to be paid to school districts

- Included, for the first time, a listing of the projected STAR monies paid by the State to districts

- Consolidated formerly separate aid categories into one “Services Aid” package

The state aid package to the Shelter Island UFSD is not likely to be reduced, but may increase if New York state receives anticipated $6 billion in federal stimulus money, Dr. Doelger said. The district’s aid package has actually increased somewhat, he said, at a time when other districts are receiving less aid. Along with other districts, Shelter Island will lobby the state Legislature to increase the Services Aid line. Meantime, the district should assume for planning purposes that no further aid will be forthcoming.

Tax levy cap

Under state law, revenues raised by the district through the property tax levy can increase no more than approximately 2 percent, or CPI, whichever is less, plus several exemptions, Dr. Doelger said. Exempt from school tax levy cap calculations are certain capital costs and unusually large rises in pensions costs. The district expects to have some exempt capital costs in the 2021/22 budget, Dr. Doelger said, but 2021/22 pension costs will not be exempt.

But the formula to determine the allowable rise is first subject to a “tax base growth factor,” which is set by the state and reflects changes in property valuations. At 1.0088, the tax base growth factor for Shelter Island UFSD is in line with other nearby school communities (shown alphabetically):

Amagansett (1.0110), Bridgehampton (1.0189), East Hampton (1.0097), Greenport (1.0079), Montauk (1.0181), Oysterponds (1.0074), Sag Harbor (1.0103), Sagaponack (1.0072), Southampton (1.0062), Southold (1.0082), Springs (1.0126), Tuckahoe Common (1.0072), and Wainscott (1.0096).

(You can read more about the formula for the tax levy cap in this NYS Cap Guidelines pdf.)

The formula also includes an “allowable levy growth factor”, also established by the state. For entities with a fiscal year that runs from July 1 to June 30 (most public school districts), this has been set at 1.0123 (see details in this chart from the state comptroller’s office).

SIUFSD Property Tax Calculation (all figures subject to change)

| Prior school year tax levy | $10,777,960.00 |

| Tax base growth factor | 1.0088 |

| Product | $10,872,806.05 |

| Capital tax levy in the prior year | $414,788.15 |

| Difference | $10,458,017.90 |

| Allowable levy growth factor | 1.0123 |

| Product | $10,586,651.52 |

| Anticipated capital tax levy in the coming year | $429,920.15 |

| Tax levy limit including exclusions | $11,016,571.67 |

School districts are required to file their tax levy limit calculations with the Office of the State Comptroller prior to approving their budget proposals. After the budget presentation on Monday, the board passed a resolution adopting the calculations in order to meet the filing requirements.

Salary costs

Most District employees are employed through a union contract and annual raises are determined through a negotiation process cannot be unilaterally changed, Dr. Doelger said. Some union contracts have provisions for raises based on years of experience, supplementary education or other negotiated methods. Anticipated salary costs are as follows:

| Category | 2020/21 Budget | 2021/22 Proposed Budget | % Change |

| Administration and General Support | $539,747 | $519,792 | -3.70 |

| Operations and Maintenance | $416,471 | $443,803 | +6.56 |

| Instructional Oversight and Development | $317,427 | $326,219 | +2.77 |

| General Education | $3,249,670 | $3,371,922 | +3.76 |

| Special Education and Wellness | $1,288,386 | $1,361,766 | +5.70 |

| Extra Curricular and Athletics | $191,317 | $202,659 | +5.93 |

| Total | $6,003,017 | $6,226,161 | +3.72 |

Administration and General Support

This area includes the Board of Education (BOE), Central Administration and Support. BOE members serve as unpaid volunteers, Dr. Doelger said, with the responsibility to:

- Adopt District policies

- Approve the hiring and dismissal of district employees

- Oversee the public’s tax dollars and assets

The District Clerk serves as the BOE secretary, recording its official actions. The district’s Central Administration includes the superintendent and the operations of his office. The district’s Business Office oversees purchasing, payroll, benefits, debt service, revenue receipt, central treasury, auditing compliance and real property insurance. Outside entities providing support:

- External Auditor, conducts annual review of the district’s finances and monetary operations

- Claims Auditor, an outside agent judges the correctness of each payment made by the district in advance of payment

- Legal Services, attorneys from the firm Ingerman Smith LLP advise the district on all legal matters

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | 2021/22 Proposed Budget | % Change | |

| BOE | $114,071 | $112,497 | $122,809 | +7.66 |

| Central Administration | $207,975 | $205,378 | $211,936 | +1.90 |

| Business Office and Treasury | $335,349 | $298,492 | $341,982 | +1.98 |

| Auditing and Legal | $100,630 | $106,931 | $104,327 | +3.67 |

| Purchasing and Personnel | $4,370 | $2,590 | $4,458 | +2.00 |

| Real Property Insurance | $53,788 | $54,812 | $57,000 | +5.97 |

| BOCES Administration | $113,932 | $110,319 | $116,210 | +2.00 |

| Total | $930,115 | $891,019 | $958,722 | +3.08 |

Operations and Maintenance

The district employs six people who are responsible to maintain, repair, clean and operate the buildings and property. The department works with outside vendors on larger projects and on specialty projects, such as the abatement of hazardous materials, Dr. Doelger said. It also works with the district’s architect/engineer on long-range planning and preventative maintenance.

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Plant Operations | $613,016 | $604,246 | $615,242 | +0.36 |

| Plant Maintenance | $262,675 | $233,039 | $292,789 | +11.46 |

| Printing & Postage | $40,450 | $27,623 | $40,050 | -0.99 |

| Total | $916,141 | $864,908 | $948,081 | +3.49 |

Academic Administration and Classroom Instruction

Two administrators and 28 teachers provide general classroom instruction to the district’s 222 students. The district also employs non-instructional personnel who assist teachers and administrators. Other classroom costs:

- Equipment is any object purchased for instructional use that costs more than $500

- Contractual expenses include field trip fees and Response to Intervention (RTI) expenses

- Materials and supplies include textbooks and instructional items under $500

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Academic Administration & Curriculum Development | $349,224 | $357,361 | $358,348 | +2.61 |

| Classroom Instructional Salaries | $3,015,215 | $2,924,009 | $3,103,482 | +2.93 |

| Classroom Non-instructional Salaries | $102,782 | $102,110 | $111,451 | +8.44 |

| Classroom Equipment | $3,780 | $2,376 | $3,780 | 0 |

| Classroom Contractual Expenses | $40,115 | $6,401 | $44,118 | +9.98 |

| Classroom Materials & Supplies | $112,488 | $108,559 | $128,105 | +4.59 |

| Total | $3,633,603 | $3,500,816 | $3,749,284 | +3.18 |

Special Areas

These areas are grouped together: Special Education, Occupational Education, Summer School, Library & Computer Instruction, and Guidance, Counseling & Health.

Students with Special Education needs receive uniquely tailored instruction, Dr. Doelger said. The academic path of Special Education students is determined by the Committee on Special Education, which writes an Individual Education Plan for each eligible student. Such instruction might include:

- Smaller class sizes

- One-to-one aides to focus on learning tasks

- Speech instruction, physical therapy and occupational therapy

- Residential settings with limited outside influences

Select high school students can attend half-day courses at BOCES to learn career and occupational skills, such as automotive and marine engine repair, barbering, and culinary, he said. Rates are set by BOCES and are subject to a three-year rolling average as a way to keep costs stable. This year, the district’s BOCES costs are higher, as a result of a rise in the rolling average.

The district provides summer reading and math instruction for elementary-aged students in the month of July.

A guidance counselor works with students to select courses and plan a cohesive and logical progression of study and helps seniors apply for college and/or prepare for career pathways. A psychologist and social worker provide counseling and specialized services to students and families. The school nurse monitors student health and works with families and local physicians to promote healthy lifestyles.

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Special Education | $1,128,480 | $807,911 | $1,170,778 | +3.75 |

| Occupational Education | $43,326 | $57,155 | $60,000 | +38.49 |

| Summer School | $23,575 | $0 | $23,575 | 0 |

| Library & Computer Instruction | $296,582 | $286,662 | $305,102 | +2.84 |

| Guidance, Counseling & Health | $464,178 | $453,222 | $496,316 | +6.92 |

| Total | $1,956,140 | $1,604,950 | $2,055,681 | +5.09 |

Co-Curricular Activities & Athletics

After-school offerings include:

- Book Craft Club

- Debate Team

- DECA Business Club

- Jazz Band

- NHS

- NJHS

- Science Club

- Select Choir

- Student Council

- Unity Club

- Video Game/Programming Club

- Yearbook

Field trip chaperones, the school newspaper and annual science fair are also funded from this section of the budget.

While the pandemic significantly altered athletics schedules and participation, the district must plan for the possibility that restrictions will be lifted so as to have funds in place to pay expenses. The district traditionally provides these athletic opportunities for students in grades 7 to 12 (KEY: b=boys, g=girls, b/g=both, V=Varsity, JV=Junior Varsity, JHS=Junior High, I=Intramural):

Baseball (boys V); Basketball (b V, b/g JV, JHS and I); Cheerleading (no level open to all); Cross Country (b/g V); Fitness (b/g I); Golf (b/g V); Running (b/g I); Softball (g JV); Tennis (b/g I); Volleyball (b/g V & JV and g JHS); and Winter Track (b/g V)

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Co-Curricular Activities | $98,331 | $58,689 | $108,469 | +10.31 |

| Athletics | $172,586 | $54,947 | $173,659 | +0.62 |

| Total | $270,917 | $113,636 | $282,128 | +4.14 |

Transportation

The district provides transportation for students both on-island as well as off-island (to any private placement within 15 miles of the students home; 50 miles for special education students). Costs include contracts to bus companies and ferry fares.

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Busing | $395,690 | $327,167 | $395,590 | -0.03 |

| Ferriage | $116,710 | $87,345 | $116,688 | -0.02 |

| Total | $512,400 | $414,512 | $512,278 | -0.02 |

Benefits

- All employees of the District are required to participate in either the New York State Teachers Retirement System (teachers and administrators) or the New York State Employees Retirement System (clerical, custodial and other support staff). The systems set contribution rates. Total anticipated pension and social security cost is $1,192,815 as follows:

| Pensions | TRS | ERS | Social Security |

| Proposed Applicable Salaries | $5,094,859 | $1,131,302 | $6,226,161 |

| Contribution Rate | 10% | 18.3% | 7.65% |

| Proposed Budget appropriation | $509,486 | $207,028 | $476,301 |

For health insurance, Dr. Doelger noted that contribution rates are negotiated in employment contracts and can only be changed through an agreement of the district and the relevant union. All active employees pay a share of health insurance, but most retirees do not as their benefits were set at the time of employment. Employees who have coverage elsewhere are eligible for a waiver payment, which is less costly for the district, Dr. Doelger noted.

The district participates in the New York State Health Insurance Program (Empire NYSHIP), along with NYS and hundreds of local government entities. NYSHIP set rates in December for the next 12 months. Schools are required to make a good-faith estimate as to what costs may be for the period January to June.

Full share costs for active employees are:

- Single = $12,898.44

- Family = $29,426.88

The total anticipated cost for health insurance is:

| Health Insurance | 2020/21 Budget | 2021/22 Proposed Budget | % Change |

| Medical Insurance Waiver | $152,537 | $167,826 | +9.11 |

| Employee Medical Insurance | $1,090,550 | $1,070,569 | -1.87 |

| Retiree Medical Insurance | $792,098 | $640,166 | -23.73 |

The district, like other employers, also has to budget for costs associated with mandated unemployment and workers compensation. The budget for benefits is as follows:

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Pension & Social Security | $1,115,287 | $325,830 | $1,192,815 | +6.95 |

| Health Insurance & Other | $2,217,855 | $1,824,718 | $2,060,687 | -7.09 |

| Total | $3,333,142 | $2,150,548 | $3,253,502 | -2.39 |

Debt Service & Transfers to Other Funds

The district has issued bonds or other borrowings that represent the unconditional promise to repay the loan according to schedules determined when the loan is finalized. School districts borrow money using Tax Anticipation Notes (TANs) in the fall to cover expenses incurred before property tax revenue is received.

Transfers to other funds include a portion of the costs of summer instruction for certain Special Education students via a Special Aid Fund grant. And, while the school/cafeteria should support itself through the sale of food to students and staff, Dr. Doelger says the cafeteria runs a deficit each year. The General Fund then must support such deficits through a transfer to the Cafeteria Fund.

| 2020/21 Budget | Spent/Encumbered by 1/15/2021 | Proposed 2021/22 Budget | % Change | |

| Bonds Principal & Interest | $366,156 | $30,578 | $365,056 | -0.30 |

| Energy Performance Contract P&I | $82,982 | $41,491 | $82,982 | 0 |

| TANs Interest | $36,000 | $20,833 | $38,775 | +7.71 |

| Transfer to Special Aid Fund | $10,425 | $0 | $11,000 | +5.52 |

| Transfer to Cafeteria Fund | $102,000 | $40,000 | $125,000 | +22.55 |

| Total | $597,563 | $132,902 | $622,813 | +4.23 |

Revenue

Dr. Doelger said SIUFSD revenue comes from three main sources:

- Property Taxes, paid by the property owners in the district

- State Aid, funds remitted to the district from New York State, as proposed by the Governor and authorized by the Legislature

- Appropriated Fund Balance (AFB), funds that are unspent from the prior year

- The district must take steps to reduce its reliance on the AFB as it becomes harder and harder each year to underspend the budget — if the AFB is not attainable, then the property tax levy must be used to make up the difference

- By instituting a multi-year, gradual reduction to the AFB, the district can create long-term financial stability

| 2020/21 Anticipated | 2021/22 Proposed | Change | |

| Property Taxes | $10,777,960 | $11,016,572 | $238,612 |

| State Aid | $657,085 | $655,371 | -$1,714 |

| Appropriated Fund Balance | $714,978 | $700,000 | -$14,978 |

| Total | $12,150,023 | $12,371,943 | $221,920 |

Budget schedule

The budget schedule is as follows:

- February 24 – Budget Workshop

- March 8 – Budget Overview and Adjustments

- April 12 – Budget Adoption by the Board of Education

- May 10 – Budget Hearing at Board of Education Meeting

- May 18 – Budget Vote, noon to 9 PM at the School Gym

To see budget materials, including Dr. Doelger’s PowerPoint slideshow, visit the district website and check under the Business Office in the Departments tab.